Hello readers here we will learn What Is a Routing Number? How to Find Your Bank Routing Number. The routing number is a digit code used to find banks in the USA. Bank uses routing numbers for exchanging funds directly from one bank to another. We can normally find the routing number at the lower corner of the check. Here we will cover more details about routing numbers so let’s get started with How to Find Your Bank Routing Number

How to Find a Routing Number

Routing numbers first time was first made by the American Bankers Association or ABD to easily circulate paper checks on larger numbers. They are known as ABA routing numbers or ACH routing numbers and can be read on personal checks, sites of banks, or the ABA online database.

Where is the Routing Number on a Check?

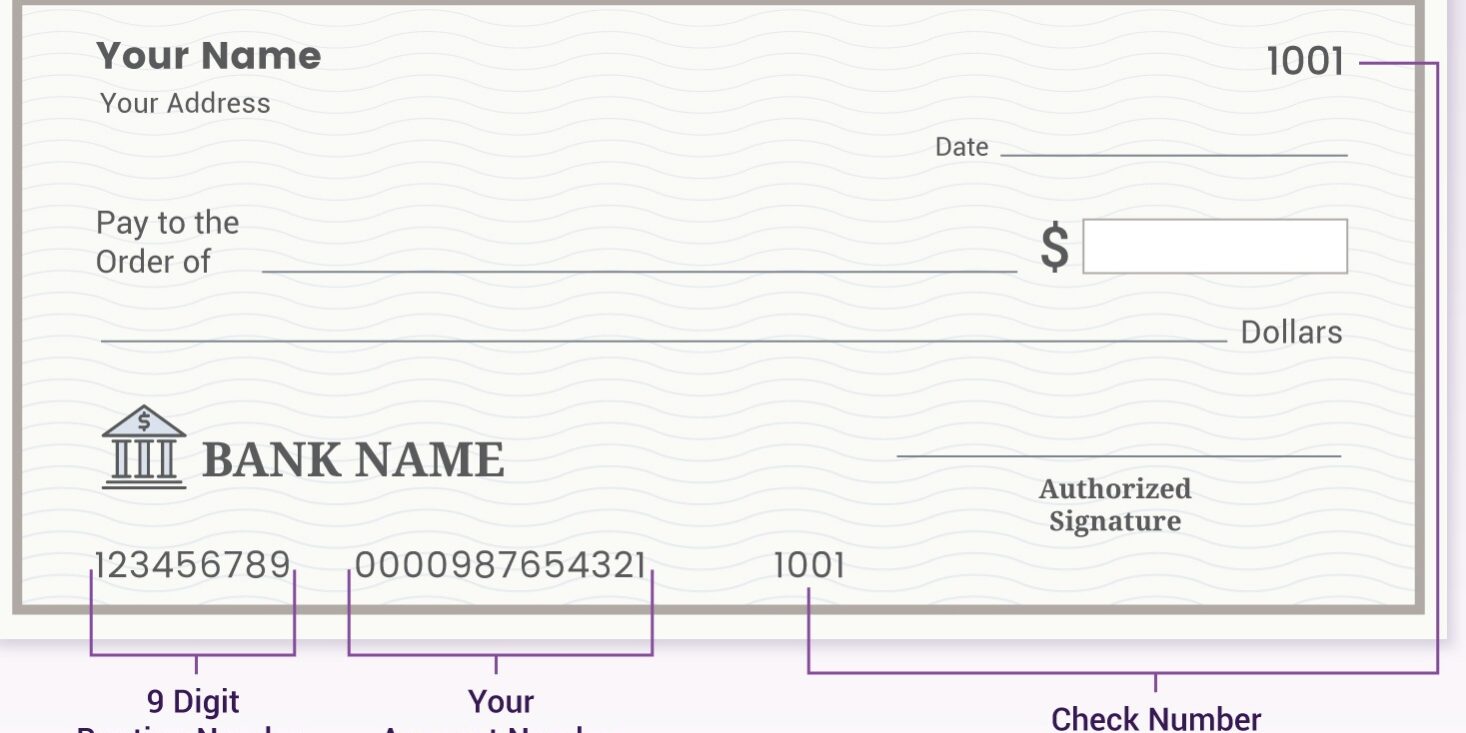

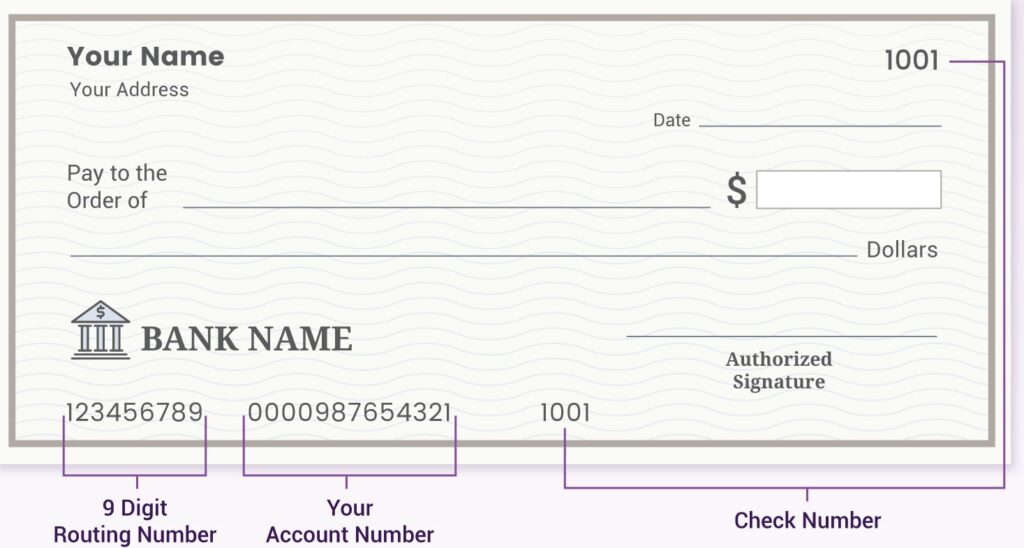

The routing number and your personal account number is mentioned in the lower part of your check provided by the bank. Mostly bank gives at least one free checkbook to new users for free of cost.

Routing Number: This number comes with 9 digits mentioned on the lower part of the check. The odd font used for printing numbers is called magnetic ink character recognition or MICR and is mentioned in electronic ink to help easily process check

Account Number: The user account number is written close to the routing number the check and is a unique identification of our bank account

Check Number: is used for recording all payments the right lower corner check number is mentioned on the check

How to Find a Routing Number Without a Check

If you do not have a check then visit the site of the bank or call the local branch to find the router number. This number can be differnt for banks and their area of location. As one bank can have many routing numbers ensure that your routing number is resultant to the certain bank where you have open accounting numbers, be sure to confirm that your routing number corresponds to the specific bank where you opened your account.

How to Find a Bank with a Routing Number (ABA Search)

If you need to get the bank through its routing number you can search through the website of ABA. With that, you can also search routing number through their website by adding the name of the bank and address. It is possible to get a check without a bank name. Federal Reserve system processes transactions with which they get bank routing numbers and account numbers. So it is important to save your personal account number

Difference Between ABA and ACH Routing Numbers?

ABA routing number can used for paper checks while an ACh routing number used for electronic transfers and withdrawals. Mostly many banks currently use routing numbers for both. However, it is not common to see distinct ABA and ACh routing numbers for regional banks.

ABA routing numbers are also called check routing numbers and ACh routing numbers since electronic routing numbers or numbers for electronic transfer. If just one number is mentioned is it chance that ABA and ACH routing numbers are similar but it does not affect contacting the bank to ensure that

Find the Routing Number on a Bank Statement

You can use the 3rd and 4th digits of your bank account number to find your routing number. The account number is written at the top of the right column of the bank statement.

Difference Between ACH and Wire Transfers?

ACH transfers are automated electronic transfers between banks that are made through 3rd party clearinghouse. While wire transfers are direct electronic transfers between banks

Wire transfers are made faster than ACH transfers as they are made by third parties as ACH does. Wire transfers can be made in some hours or also in minutes. But ACH transfer can take some days. Wire transfer is more secure since each bank should verify the transaction before it clears, while ACH transfer normally clears automatically

Normally banks charge from 15$ to 65$ to send and receive wire transfers, while ACH transfer is free. Due to the cost involved wire transfers are bet for larger amounts of processing or transfers where funds must reach to destination in a short time. read also our latest post on Verizon SIM Card Not Working

Routing Number vs. Account Number

For any transaction like setting up direct deposit or ordering checks online, there is a need bank routing number and account number.

The account number is like a customer ID or fingerprint that is assigned to the account holder. Routing and account numbers are assigned to define accurately where funds in transactions are going and coming.

A routing number is the identification of each bank with a differnt numerical ID. Any time we can make electronic funds transfer like routing an account number should be given to the related bank. Routing is 9-digit number and account is 9 to 12-digit numbers but for some banks can be longer.

What are SWIFT and IBAN Codes?

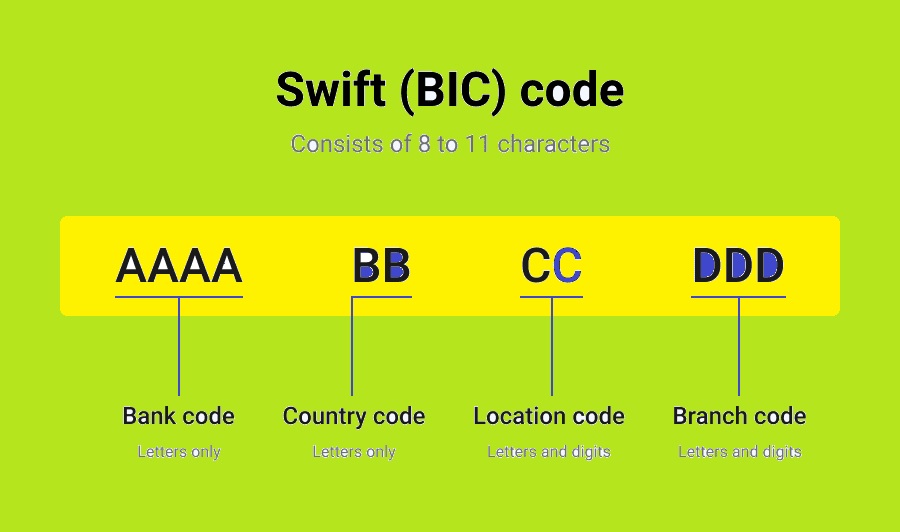

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication Code that identifies banks in international transactions like ABA or ACH number defines banks in US domestic transactions.

IBAN stands for International bank account number that identifies a personal account in international transactions. it is normally the same as like account number having some additional digits added in an internationally defined format. If you need to send funds at the international level then you need the IBAN of the receiving bank.

IBAN and SWIFT are made for international identification systems of banks. While the USA sues the ABA system for transactions locally, US banks accept and transmit funds with the use of the SWIFT system for multinational transactions.

What Is an IBAN Number?

The IBAN number is an international bank account number global standard for sending bank payments. It has 34 alphanumeric characters that help to find a bank, country branch, and account.

North American Asian countries and Australia do not use IBAN for local transfer of money and use for a country that works IBAN’s

Faqs

How do I need My Routing number?

There is the routing number used by the financial institutions that make transactions in the USA. They will ask for it when you make a direct deposit and pay the bill online by phone or for a wire transfer.

How to find my routing number?

You can find your bank routing number by looking at the 9-digit number in the lower left corner of the check. If you do not have a check then use the bank site and your account statement